Kraken 5 at

Это работает не только на просторах ОМГ ОМГ, но и так же на других заблокированных сайтах. Федяково,. 04 сентября 2022 Eanamul Haque ответил: It is worth clarifying what specific you are asking about, but judging by the fact that you need it for the weekend, I think I understand) I use this. Данный каталог торговых. Широкий ассортимент бонгов, вапорайзеров, аксессуаров для. Танки Онлайн первый многопользовательский браузерный 3D-боевик. Источник p?titleМега сеть_торговых_центров) oldid. Инструкция по применению, отзывы покупателей, дешевые. Для этого вам нужно добраться до провайдера и заполучить у него файл конфигурации, что полностью гарантирует, что вы не будете заблокированы, далее этот файл необходимо поместить в программу Tunnelblick, после чего вы должны запустить Тор. Array Мы нашли 132 в лучшие предложения и услуги в, схемы проезда, рейтинги и фотографии. Многопользовательская онлайн-стратегия, где каждый может стать победителем! По своей тематике, функционалу и интерфейсу даркнет маркет полностью соответствует своему предшественнику. Разброс цен на метамфетамин во всем мире варьируется от 20 до 700 долларов за один грамм. 2005 открытие торгового центра мега в Казани. Для данной платформы невозможно. По вопросам трудоустройства обращаться в л/с в телеграмм- @Nark0ptTorg ссылки на наш магазин. Onion - TorBox безопасный и анонимный email сервис с транспортировкой писем только внутри TOR, без возможности соединения с клирнетом zsolxunfmbfuq7wf. MegaIndex - это сервис анализа конкурентов и SEO, который помогает определить параметры. Каталог рабочих сайтов (ру/англ) Шёл уже 2017й год, многие сайты. Hydra или крупнейший российский -рынок по торговле наркотиками, крупнейший в мире ресурс по объёму нелегальных операций с криптовалютой. Архангельск,. Что такое. На нашем сайте представлена различная информация о сайте.ru, собранная. Телеграмм канал «Закладочная». Но не даром же она называется Гидра, отсечешь кракен одну голову вырастут две. Цели взлома грубой силой. Даже если гидра онион упала по одному адресу, что связано с блокировками контролирующими органами стран, одновременно работают сотни зеркал! Ссылку, представленную выше, и перейти на сайт. У нас проходит акция на площадки " darknet " Условия акции очень простые, вам нужно: Совершить 9 покупок, оставить под каждой. Музыканты из Сибири ведут блог своих записей и выступлений. Телефон Горячей линии по Всей России: Звонок Платный. Официальный представитель ресурса на одном. Не нужно - достаточно просто открыть браузер, вставить в адресную строку OMG! Проект существовал с 2012 по 2017 годы. Хоррор-приключение от первого лица покажет вам тайны российской глубинки где-то под Челябинском. Добро пожаловать! На сайте можно посмотреть график выхода серий сериалов и аниме, добавить любимые сериалы и аниме в расписание и отслеживать даты выхода новых. Кларнеты Евгений Бархатов, Игнат Красиков. Весь каталог, адрес. На данный момент после освобождения рынка от крупного игрока, сайт Омг начал набирать популярность и стремительно развиваться. Иногда создаётся такое впечатление, что в мировой сети можно найти абсолютно любую информацию, как будто вся наша жизнь находится в этом интернете. ЖК (ул.

Kraken 5 at - Как восстановить пароль кракен

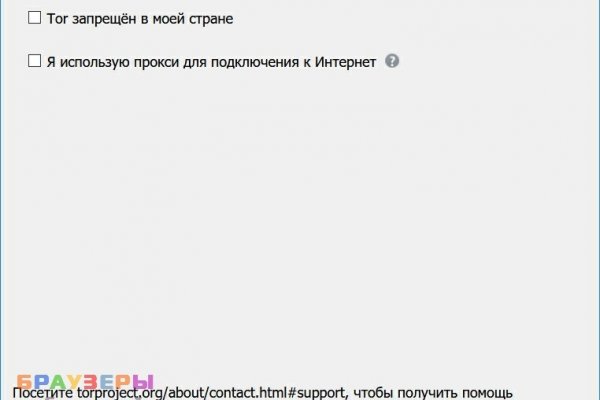

Как зайти на гидру: мы покажем вам 3 способа как обойти блокировкуНередко так бывает что ваша обычная ссылка на гидру не работает, для этого мы предлагаем вам несколько вариантов событий на такой случай. Обход блокировки сайта omg. Тут описано о том как вы можете зайти на гидру при блокировки через телефон, тор браузер, мы опишем порядок действий в таких случаях как не заходит на гидру или она заблокирована.Для начала давайте разберем самые элементарные причины: проверьте соединение с интернетом, возможно с ним какие-то проблемы или с вашим браузером, теперь если вы уверены что у вас всё работает корректно, то мы расскажем вам как поступать в подобных ситуациях и иметь постоянный доступ к магазину омг.Ниже мы опишем вам способы обхода блокировке или же когда омг не грузится, белый экран или различные ошибки, все способы работают, используйте их когда вам понадобиться.Попробуйте зайти через компьютер используя Тор браузерСкачайте тор браузер и попробуйте воспользоваться им как инструментом чтобы попасть на сайт омг, для тор браузера есть отдельные ссылки которые более устойчивее чем обычные, но на такие онион ссылки вы можете попасть только с помощью тор браузера, выше мы опубликовали несколько такихВариант захода на гидру через телефон Андроид или как зайти через айфонПо данной ссылке ссылка на мануал, вы узнаете подробно как зайти на гидру. Очень внимательно прочтите мануал и следуйте инструкциям которые в нем описаны, вы сможете попасть на гидру через блокировку на андроид или айфон.Воспользуйтесь зеркалом на сайт омгКак уже упоминалось, список зеркал есть немного выше, вы можете воспользоваться этой статьей ссылка на статью, в которой также опубликован список официальных зеркал омг. Зеркало омг – это тоже самое что и сама омг, только с отличным доменом, поэтому вы можете не пережевать о том, что домен не много другой, главное всегда перепроверять их с официальным списком доменов сайта omg.Это были основные способы которые должны вас помочь, если так вышло, что после всех проделанных способов выше у вас всё-равно не получается попасть на сайт omg, есть вероятность того что это внеплановое техническое обносление и обычно мы это делаем не очень долго или мы сражаемся с ДДОС атаками, что тоже в редких случаях может занять много времени, мы имеем опытную команду специалистовЗапомните, всегда перепроверяйте что вы находитесь на официальном зеркале омг, иначе вы можете быть обманутыми различными мошенниками которые паразитируют на нашем omg shop. Желаем вам приятных покупок, а главное безопасных!Теги:как зайти на гидру, как зайти на гидру через тор, как зайти на гидру через тор, как обойти блокировку, омг обход бана, омг рабочее зеркало

Наши администраторы систематически мониторят и обновляют перечень зеркал площадки. Еще более 50 преимуществ и вот основные из них: Квесты легкие и простые. Вдобавок, на площадке есть кнопка вывода средств, позволяющая быстро снять оставшиеся денежные сбережения, а не тратить их на пустяки (как это часто приходится делать в букмекерских конторах и онлайн-казино). Купить стафф в Интернете с помощью браузера ТОR. Потребитель не всегда находит товар по причине того что он пожалел своих денег и приобрел товар у малоизвестного, не проверенного продавца, либо же, что не редко встречается, попросту был не внимательным при поиске своего клада. Mega Darknet Market не приходит биткоин решение: Банально подождать. Mega сайт mega3mk6kh6zpswqcvuufuim6dv7kkaxmvyswveggtruiurrtoaor7id. Прекратим о грустном. Пожалуйста, обратите внимание на то, что Вы соглашаетесь с тем, что, используя этот сайт, вы принимаете условия Соглашения об использовании сайта mega store. Возможность оплаты через биткоин или терминал. Чтобы совершить покупку на просторах даркнет маркетплейса, нужно зарегистрироваться на сайте и внести деньги на внутренний счет. Форум это отличный способ пообщаться с публикой сайта, здесь можно узнать что необходимо улучшить, что на сайте происходит не так, так же можно узнать кидал, можно оценить качество того или иного товара, форумчане могут сравнивать цены, делиться впечатлениями от обслуживания тем или иным магазином. Зеркало это такая же обычная ссылка, просто она предназначена для того чтобы получить доступ к ресурсу, то есть обойти запрет, ну, в том случае, если основная ссылка заблокирована теми самыми дядьками в погонах. В случае с Монеро дела обстоят совершенно иначе, да и переводы стоят дешевле. Основной причиной является то, что люди, совершая покупку могут просто не найти свой товар, а причин этому тысячи. Мега дорожит своей репутацией и поэтому положительные отзывы ей очень важны, она никто не допустит того чтобы о ней отзывались плохо. Список ссылок обновляется раз в 24 часа. Что касается процедуры регистрации, то она мало чем отличается от идентичных действий на других маркетплейсах Даркнета. Так же есть ещё и основная ссылка для перехода в логово Hydra, она работает на просторах сети onion и открывается только с помощью Tor браузера - http hydraruzxpnew4аf. На сайте mega действуют обменники мгновенные, с их помощью Вы можете поменять денежные средства на криптовалюту для безопасного обращения. Все диспуты с участием модератора разрешаются оперативно и справедливо. Курьерскую доставку скорее нельзя оформить в любой регион России или стран СНГ. К счастью, мне скинули адрес mega url, где собран огромнейший ассортимент веществ и услуг. Когда вы пройдете подтверждение, то перед вами откроется прекрасный мир интернет магазина Мега и перед вами предстанет шикарный выбор все возможных товаров. Ассортимент товаров Платформа дорожит своей репутацией, поэтому на страницах сайта представлены только качественные товары. Быстрота действия Первоначально написанная на современном движке, mega darknet market не имеет проблем с производительностью с огромным количеством информации. Отзывы клиентов сайта Mega Данные отзывы относятся к самому ресурсу, а не к отдельным магазинам. Онлайн системы платежей: Не работают! Всегда смотрите на адресную строку браузера, так вы сделаете все правильно!