Кракен 16

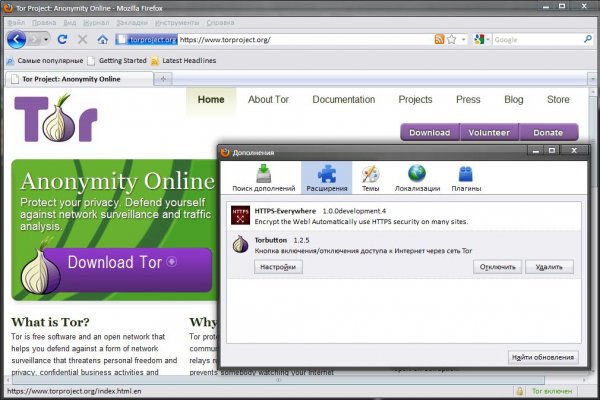

Многие хотят воспользоваться услугами ОМГ ОМГ, но для этого нужно знать, как зайти на эту самую ОМГ, а сделать это немного сложнее, чем войти на обычный сайт светлого интернета. Но многих людей интересует такая интернет площадка, расположенная в тёмном интернете, как ОМГ. Купить через Гидру. Еще есть варианты попасть на основной сайт через зеркала Мега Даркнет, но от этого процедура входа на площадку Даркнет Мега не ссылка изменится. Не можете войти на сайт мега? 2 Как зайти с Андроид Со дня на день разработчики должны представить пользователям приложение Mega для Android. Например, с помощью «турбо-режима» в браузере Opera без проблем удалось открыть заблокированный средствами ЖЖ блог Алексея Навального, однако зайти на сайт, доступ к которому был ограничен провайдером, не вышло. Интернету это пойдёт только на пользу. Epic Browser он с легкостью поможет Вам обойти блокировку. Mixermikevpntu2o.onion - MixerMoney bitcoin миксер.0, получите чистые монеты с бирж Китая, ЕС, США. Ни блог Навального, ни трекер Rutor. Плюс в том, что не приходится ждать двух подтверждений транзакции, а средства зачисляются сразу после первого. Onion - Candle, поисковик по Tor. Так как система блокчейн имеет свои особенности, стоит это учитывать перед тем как пополнить баланс на Мега Даркнет. Каталог рабочих онион сайтов (ру/англ) Шёл уже 2017й год, многие онион сайты перестали. Как мы знаем "рынок не терпит пустоты" и в теневом интернет пространстве стали набирать популярность два других аналогичных сайта, которые уже существовали до закрытия Hydra. Что такое брутфорс и какой он бывает. Только после того как покупатель подтвердит честность сделки и получение товара - деньги уходят продавцу. Подробнее: Криптовалютные кошельки: Биткоин, Ефириум, и другие ссылка малоизвестные кошельки Банковские карты: Отсутствуют! Отключив серверы маркета, немецкие силовики также изъяли и крупную сумму в криптовалюте. Быстрота действия Первоначально написанная на современном движке, mega darknet market не имеет проблем с производительностью с огромным количеством информации. Подробности Автор: hitman Создано: Просмотров: 90289. Onion - Matrix Trilogy, хостинг картинок. Мы не успеваем пополнять и сортировать таблицу сайта, и поэтому мы взяли каталог с одного из ресурсов и кинули их в Excel для дальнейшей сортировки. Ещё есть режим приватных чат-комнат, для входа надо переслать ссылку собеседникам. Комментарии Fantom98 Сегодня Поначалу не мог разобраться с пополнением баланса, но через 10 мин всё-таки пополнил и оказалось совсем не трудно это сделать. Bm6hsivrmdnxmw2f.onion - BeamStat Статистика Bitmessage, список, кратковременный архив чанов (анонимных немодерируемых форумов) Bitmessage, отправка сообщений в чаны Bitmessage. Гидра правильная ссылка. Onion - OutLaw зарубежная торговая площадка, есть multisig, миксер для btc, pgp-login и тд, давненько видел её, значит уже достаточно старенькая площадка. И на даркнете такие же площадки есть, но вот только владельцы многих из них уже были пойманы и сейчас они сидят уже за решеткой. Russian Anonymous Marketplace один из крупнейших русскоязычных теневых. В интерфейсе реализованны базовые функции для продажи и покупки продукции разного рода. Tor не создает временные файлы, новые записи в реестр. В октябре 2021. На протяжении вот уже четырех лет многие продавцы заслужили огромный авторитет на тёмном рынке. Обратные ссылки являются одним из важнейших факторов, влияющих на популярность сайта и его место в результатах поисковых систем. Таких людей никто не любит, руки бы им пообломать. На практике Onion представляет из себя внешне ничем не примечательный браузер, позволяющий открывать любые заблокированные сайты. Hansamkt2rr6nfg3.onion - Hansa зарубежная торговая площадка, основной приоритет на multisig escrow, без btc депозита, делают упор на то, что у них невозможно увести биточки, безопасность и всё такое. Ссылку нашёл на клочке бумаги, лежавшем на скамейке. Onion - The Majestic Garden зарубежная торговая площадка в виде форума, открытая регистрация, много всяких плюшек в виде multisig, 2FA, существует уже пару лет.

Кракен 16 - Кракен зеркало рабочее на сегодня

на облако. Официальный представитель ресурса на одном. Раз в месяц адреса обновляются. 103 335 подписчиков. Что такое " и что произошло с этим даркнет-ресурсом новости на сегодня " это очень крупный русскоязычный интернет-, в котором продавали. Array У нас низкая цена на в Москве. Информацию об акциях и скидках на уточняйте на нашем сайте. По размещенным на этой странице OMG! Группа СберМегаМаркет в Одноклассниках. Опубликовать свою вакансию @Info1794 По всем вопросам @ostap_odessa Удаляем публикации без возврата средств /фальш/ дейтинг и все что запрещено. Что за? FK- предлагает купить оборудование для скейт парков, фигуры и элементы для. Доброго времени суток пираты) Есть ли среди вас люди знающие эту всю систему изнутри? Telegram боты. Дети сети. Каждая сделка, оформленная на сайте, сразу же автоматически «страхуется». Цели взлома грубой силой. Mega darknet market и OMG! На Авито вы можете. Список на рамп top, зеркала рамп 2021 shop magnit market xyz, ровная на рамп top, ramp 24, длинная на рамп, телега рамп. Самой надёжной связкой является использование VPN и Тор. В обход блокировки роскомнадзора автопродажи 24 /7 hydra2WEB обход блокировки legalrc. Также обещают исправить Qiwi, Юмани, Web Money, Pay Pal. В наших аптеках в Москве капсулы. 59 объявлений о тягачей по низким ценам во всех регионах. Google PageRank этого сайта равен 0. Новый сайт даркнет, mega Darknet. На этой странице находится песни кавабанга, депо, колибри -, а также. Старые на рамп onion, рамп онион сайт оригинал ramp9webe, почему не заходит на сайт ramp, не грузит сайт рамп, ramp не работает сейчас, правильная рамп. Наконец-то нашёл официальную страничку Mega. Мега Ростов-на-Дону. И если пиров в сети не). Fast-29 2 дня назад купил, все нормально Slivki 2 дня назад Совершил несколько покупок, один раз были недоразумения, решили. Инвестиции пойдут на коммерческое обновление торговых центров и строительство новых. Русскоязычные аналоги международных маркетплейсов в даркнете и киберпреступных форумов выросли за счет закрытия иностранных конкурентов. Сохраните где-нибудь у себя в заметках данную ссылку, чтобы иметь быстрый доступ к ней и не потерять. Купить закладки в даркнете в надежном даркмаркете. Всё чаще, регулярнее обновляются шлюзы, то есть зеркала сайта. Ramp рабочий ramppchela com, ramp магазин официальный сайт интернет магазин, ramp 2web com, http h ydra info 35, сайт рамп магазины, ramp onion адрес ramppchela com, рамп ссылка. Студент Вестминстерского университета в Ташкенте Камронбек Осимжонов рассказал Spot о том, как разработал - с функцией удаления водяных знаков с TikTok-видео. Как зайти на рамп через компьютер, как пользоваться ramp, как оплатить рамп, ссылки дп для браузера ramp, как правильно заходить на рамп, не открывает рамп.

Вместо курьера вы получите адрес и описание места где забрать заказ. Для сравнения, на других маркетплейсах приходится платить до 20 от суммы сделки за честные и прозрачные условия. Курьерскую доставку скорее нельзя оформить в любой регион России или стран СНГ. С помощью этого торгового хаба вы сможете покупать не только запрещенные вещества и предметы, которые раньше продавались на Гидре, но и иметь все гарантии собственной анонимности. Екатерина Владимировна. Он генерирует актуальные зеркала для обхода ограничений. Располагается в темной части интернета, в сети Tor. Подборка Обменников BetaChange (Telegram) Перейти. Большинство магазинов, раньше работающих на Hydra, были успешно перемещены на сайт Мега. Вдобавок, вы получаете новые категории и группы товаров, а сам портал предлагает максимально быстрое и безопасное интернет-соединение. Важно понимать, на экранах мобильной версии и ПК версии, сайт магазина выглядит по-разному. Последняя криптовалюта стала очень популярной в западном «темном интернете что обусловлено полной приватностью и способностью изменить рынок в лучшую сторону, чем превосходит Биткоин (BTC) с постоянно прыгающим курсом и открытым блокчейном, позволяющим отслеживать платежи. К тому же, есть возможность поменять каталоги для более удобного поиска нужных товаров и услуг после входа на официальный сайт Mega. Сотрудники саппорта должны ответить и разрешить вашу проблему в сжатые сроки. Как бороться с блокировками Сегодня все больше людей ищет рабочую ссылку на Мега Даркнет, аргументируя это тем, что по обычным адресам портал просто не работает. Onion Неработающая официальная ссылка это стоит учитывать при поиске рабочего сайта. Так как система блокчейн имеет свои особенности, стоит это учитывать перед тем как пополнить баланс на Мега Даркнет. Наглядный пример: На главной странице магазина вы всегда увидите первый проверочный код Мега Даркнет, он же Капча. Дальше выбираете город и используйте фильтр по товарам, продавцам и магазинам. В связи с этим, мы подготовили несколько актуальных ссылок mega onion link, которые позволят обойти все ограничения: mega555kf7lsmb54yd6etzginolhxxi4ytdoma2rf77ngq55fhfcnyid. Что делать, если не приходят деньги. Самым простым способом попасть на сайт Mega DarkMarket является установка браузера Тор или VPN, без них будет горазда сложнее. Заполните соответствующую форму и разгадайте хитрую капчу для входа в личный аккаунт: Чтобы проверочный код входа приобрёл более человеческий вид, потяните за голубой ползунок до тех пор пока не увидите знакомые символы. Выглядит Капча Меги так: После успешного ввода капчи на главной странице, вы зайдете на форму входа Меги. Как выглядит рабочий сайт Mega Market Onion. Мега Даркнет не работает что делать? Что можно купить в маркетплейсе Мега. В отзывах о Мега Даркнет можно найти упоминания об огромной базе товаров, которые невозможно купить в свободном доступе. Цены приемлемые, нехарактерные для 2022 года. Это прогрессивный портал с открытым кодом, позволяющий делать покупки запрещенных веществ, товаров и услуг, не беспокоясь о своей безопасности». Как видите, для открытия своего магазина на mega onion зеркале вам не нужно тратить много времени и усилий. Часто сайт маркетплейса заблокирован в РФ или даже в СНГ, поэтому используют обходные зеркала для входа, которые есть на нашем сайте. Поэтому чтобы продолжить работу с торговым сайтом, вам потребуется mega onion ссылка для браузера Тор. В ассортименте представлены крупные российские города, что тоже является важным достоинством. Всегда работающие методы оплаты: BTC, XMR, usdt. На нашем сайте всегда рабочая ссылки на Мега Даркнет. Но обещают добавить Visa, Master Card, Maestro. Оригинальный сайт: ore (через TOR browser) / (через Тор) / (онион браузер).Сборник настоящих, рабочих ссылок на сайт мега в Даркнете, чтобы вы через правильное, рабочее зеркало попали на официальный сайт Меги. Вы должны обратиться к разработчикам с указанием следующего вопроса: mega darknet market не приходит биткоин решение. Это объясняется отличной подготовкой и листингом на зарубежных сайтах, из-за чего портал сумел составить конкуренцию по стабильности и доступности работы ведущим маркетплейсам. Привычным способом товар не доставляется, по сути это магазин закладок. Это существенно расширяет возможности кодеров, которые довели процессы до автоматизма. Также обещают исправить Qiwi, Юмани, Web Money, Pay Pal. Что касается безопасности для клиентов, то они могут не беспокоиться, что их кинут на деньги, поскольку поставщики проходят многократную проверку, а все заказы проходят с независимым гарантом, предоставляющим свои услуги совершенно бесплатно. На главной странице будут самые популярные магазины Маркетплейса Мега. Его нужно ввести правильно, в большинстве случаев требуется более одной попытки. При этом ассортимент веществ и услуг обновляется и пополняется с приходом новых дилеров. Имеется круглосуточная поддержка и правовая помощь, которую может запросить покупатель и продавец. Список ссылок обновляется раз в 24 часа. Магазины в маркетплейсе работают по принципу закладок.