Кракен тор ссылка

Ваш браузер использует блокировщик рекламыОн мешает корректной работе сайта.

Отключите блокировщик или добавьте moika78.ru в белый список, чтобы закрыть это сообщениеУ Дмитрия Павлова есть 10 дней, чтобы обжаловать решение суда. Фото: РixabayВ Москве арестован предполагаемый основатель онлайн-площадки «ОМГ» Дмитрий Павлов. Об этом говорится в электронной базе данных суда.В электронной базе Мещанского суда появилась информация о том, что 11 апреля было вынесено решение о заключении под стражу Дмитрия Павлова, обвиняемого в сбыте и пересылке наркотических средств в особо крупном размере.Как сообщает издание «ТАСС», данное постановление еще не вступило в законную силу. У Павлова есть 10 дней, чтобы обжаловать его.Напомним, что Минюст США внес в санкционный список интернет-площадку даркнета. Как считают американские власти, руководство этой площадки находилось на территории России и других стран СНГ.Ранее Мойка78 сообщала о том, что США отказывается возвращать яхты российским бизнесменам.Текст: Вероника КазакевичНовости партнеровАфишаВ Петербурге покажут спектакль «Лжец» по пьесе Карло ГольдониВластьДрозденко провел совещание с главой подшефного города Енакиево в ДНР ХраменковымМненияФедор Грудин: «Есть ощущение, что будут тыкать аккаунт мусорные площадки, где проще, а не с умом»14 апреля 2022, 15:142022-04-19T13:12Смольный в очередной раз может сузить круг полномочий петербургских муниципалитетов. На этот раз -...Адрес редакции: 197022 Россия, Санкт-Петербург, пр. Медиков, 9Показать ещеБизнесМеждународная служба экспресс-доставки DPD не оправдала ожидания клиентаПетербуржец Сергей обратился в общественную приемную Мойки78 и рассказал о неудобствах, которые испытал, заказав чехол для любимой гитары с доставкой DPD.ИнтервьюПокрас Лампас о российском футболе, ЕВРО 2020, «Единстве» и современном искусствеwpDiscuz© Moika78.ru 2017 - 2022

Главные новости дняСвидетельство о регистрации СМИ. Номер: вывод ЭЛ № ФС 77 - 76062 выдано Федеральной службой по надзору в сфере связи, информационных технологий и массовых коммуникаций (Роскомнадзор) 19 купить июня 2019 годаАдрес редакции: 197022 Россия, Санкт-Петербург, пр. Медиков, 9О редакции

Кракен тор ссылка - Как вернуть аккаунт на кракене

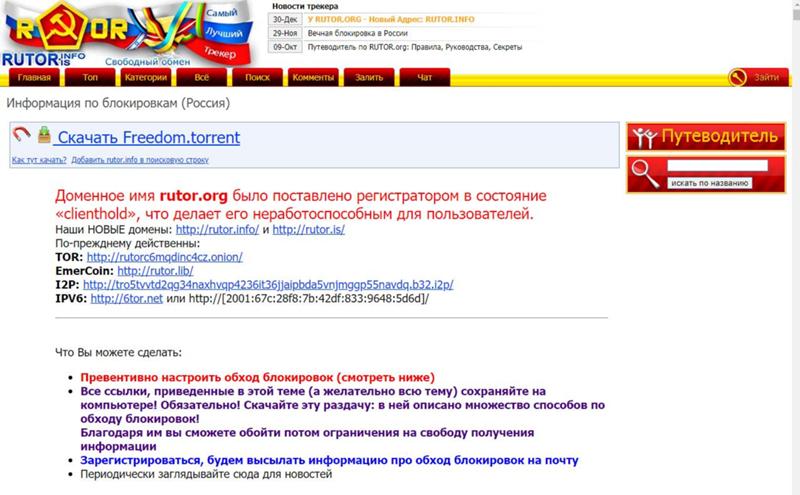

Увидев, что не одиноки, почувствуете себя лучше. Onion - Архив Хидденчана архив сайта hiddenchan. Onion - Neboard имиджборд без капчи, вместо которой используется PoW. Onion - Dead Drop сервис для передачи шифрованных сообщений. Населен русскоязычным аноном после продажи сосача мэйлру. Onion - Mail2Tor, e-mail сервис. Vtg3zdwwe4klpx4t.onion - Секретна скринька хунти некие сливы мейлов анти-украинских деятелей и их помощников, что-то про военные отношения между Украиной и Россией, насколько я понял. Tetatl6umgbmtv27.onion - Анонимный чат с незнакомцем сайт соединяет случайных посетителей в чат. Ml -,.onion зеркало xmpp-сервиса, требует OTR. Onion - XmppSpam автоматизированная система по спаму в jabber. Ссылку нашёл на клочке бумаги, лежавшем на скамейке. Onion - Tor Metrics статистика всего TORа, посещение по странам, траффик, количество onion-сервисов wrhsa3z4n24yw7e2.onion - Tor Warehouse Как утверждают авторы - магазин купленного на доходы от кардинга и просто краденое. Есть закрытые площадки типа russian anonymous marketplace, но на данный момент ramp russian anonymous marketplace уже более 3 месяцев не доступна из за ддос атак. Пользуйтесь на свой страх и риск. Onion - Konvert биткоин обменник. Onion - MultiVPN платный vpn-сервис, по их заявлению не ведущий логов. Org, список всех.onion-ресурсов от Tor Project. Английский язык. Комиссия от 1. Kkkkkkkkkk63ava6.onion - Whonix,.onion-зеркало проекта Whonix. Просмотр. Underdj5ziov3ic7.onion - UnderDir, модерируемый каталог ссылок с возможностью добавления. 2qrdpvonwwqnic7j.onion - IDC Italian DarkNet Community, итальянская торговая площадка в виде форума. Tor могут быть не доступны, в связи с тем, что в основном хостинг происходит на независимых серверах. Возможность создавать псевдонимы. Onion - Архива. UPD: похоже сервис умер. Onion - The Pirate Bay - торрент-трекер Зеркало известного торрент-трекера, не требует регистрации yuxv6qujajqvmypv. Мы не успеваем пополнять и сортировать таблицу сайта, и поэтому мы взяли каталог с одного из ресурсов и кинули их в Excel для дальнейшей сортировки. По слухам основной партнер и поставщик, а так же основная часть магазинов переехала на торговую биржу. TLS, шифрование паролей пользователей, 100 доступность и другие плюшки. Просмотр.onion сайтов без браузера Tor(Proxy). Onion - Privacy Tools,.onion-зеркало сайта. Торрент трекеры, Библиотеки, архивы Торрент трекеры, библиотеки, архивы rutorc6mqdinc4cz. Рейтинг продавца а-ля Ebay.

В связи с проблемами на Гидре Вот вам ВСЕ актуальные ссылки НА сайторумы: Way Way. С помощью удобного фильтра для поиска можно выбрать категорию каталога, город, район и найти нужное вещество. Официальный представитель ресурса на одном. И если пиров в сети. Мария. Проверь свою удачу! Оригинал сайт рабочая ссылка. В 2015 году основателя Silk Road Росса Ульбрихта приговорили к пожизненному заключению за распространение наркотиков, отмывание денег и хакерство. Ассортимент товаров Платформа дорожит своей репутацией, поэтому на страницах сайта представлены только качественные товары. Ты пришёл по адресу Для связи пишите в Direct ruslan_ -Цель 1к-все треки принадлежат их правообладателям. IMG Я не являюсь автором этой темы. Хотите узнать.nz? Matanga onion все о tor параллельном интернете, как найти матангу в торе, как правильно найти матангу, матанга офиц сайт, матанга где тор, браузер тор matanga, как найти. Репутация При совершении сделки, тем не менее, могут возникать спорные ситуации. Капча Судя по отзывам пользователей, капча на Омг очень неудобная, но эта опция является необходимой с точки зрения безопасности. Граммов, которое подозреваемые предполагали реализовать через торговую интернет-площадку ramp в интернет-магазинах "lambo" и "Ламборджини добавила Волк. Зеркала рамп 2021 shop magnit market xyz, ramp не работает почему, рамп магадан сайт, рамп. Как открыть заблокированный сайт. Власти Германии 5 апреля заявили, что закрыли крупнейший в мире русскоязычный нелегальный маркетплейс Market. И тогда uTorrent не подключается к пирам и не качает). Ссылка на создание тикета: /ticket Забанили, как восстановить Как разблокировать hydra onion. Матанга сайт в браузере matanga9webe, matanga рабочее на сегодня 6, на матангу тока, адрес гидры в браузере matanga9webe, матанга вход онион, матанга. Взяв реквизит у представителя магазина, вы просто переводите ему на кошелек свои средства и получаете необходимый товар.