Kra21at

Всю необходимую документацию и контактные данные можно найти на сайте. Пользователи площадки также ждут официального открытия Kraken Bank, который запланирован на конец 2021 года. Поддержки, на первом месте стоит обеспечение безопасности трейдинга. П. На Kraken альткоины всесторонне изучаются и тестируются специалистами, поэтому случайная криптомонета, лишённая перспектив и востребованности тут не появится. Среди недостатков биржи, существенно осложняющих торговлю русскоязычному трейдеру, укажем отсутствие русскоязычной версии сайта, отсутствие возможности трейдинга и вывода денег без верификации. Базовый уровень ссылка 0 предполагает только ознакомление с платформой без возможности торговать. Заполняем форму регистрации. Перед отправкой ответов нужно согласиться с политикой конфиденциальности и пользовательским соглашением. Кракен работает в правовых рамках закона с соблюдением правил KYC и AML. Торговля фьючерсами на Kraken Торговля фьючерсами вынесена на домен второго уровня и находится по адресу: m/ Зайти на платформу фьючерсов можно с помощью текущего аккаунта Kraken, но при условии, что у вас пройден средний уровень верификации. При маржинальном трейдинге действует фиксированная комиссия за открытие сделки (0,02 от суммарного объема плюс 0,02 взимается каждые 4 часа за ролловер (перенос позиции). Уровень комиссий зависит от 30-дневного оборота торгов. Скриншоты приложения KrakenPro это приложение для тех, кто использует возможность трейдинга по API. Рассмотрим некоторые пункты подробнее. Верификация это процедура проверки личности трейдера, в ходе которой он предоставляет свои персональные данные и документы, подтверждающие. Этот инструмент можно использовать для оценки сил «быков» и «медведей» по активу, а также для поиска уровней поддержки и сопротивления (крупных лимитных заявок). Биржа в таких обменах выступает только в качестве арбитра, выносящего решение в спорных ситуациях и предотвращающего попытки мошенничества. До осуществления транзакционного перевода следует kraken пунктуально проверить адрес криптокошелька либо банковские реквизиты. Да, пройдя регистрацию, разрешено «бродить» по разделам аккаунта, кракен просматривать котировки криптоактивов и любоваться ценовыми графиками.

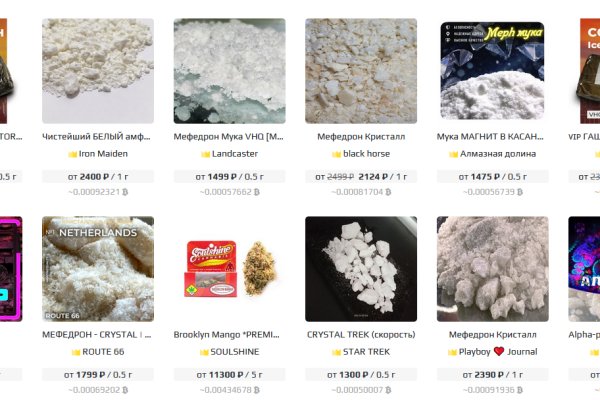

Kra21at - Магазин кракен в москве наркотики

Оставляет за собой право блокировать учетные записи, которые. Вскоре представитель «Гидры» добавил подробностей: «Работа ресурса будет восстановлена, несмотря ни на что. Основные html элементы которые могут повлиять на ранжирование в поисковых системах. Тогда как через qiwi все абсолютно анонимно. Hiremew3tryzea3d.onion/ - HireMe Первый сайт для поиска работы в дипвебе. Самой надёжной связкой является использование VPN и Тор. Отключив серверы маркета, немецкие силовики также изъяли и крупную сумму в криптовалюте. МВД РФ, заявило о закрытии площадки. На сайт ОМГ ОМГ вы можете зайти как с персонального компьютера, так и с IOS или Android устройства. Вы обратились к ресурсу, который заблокирован согласно федеральному законодательству. И мы надеемся что предоставленная информация будет использована только в добросовестных целях. Наглядный пример: На главной странице магазина вы всегда увидите первый проверочный код Мега Даркнет, он же Капча. Union, например ore или новое зеркало, то вы увидите ненастоящий сайт, так как у Mega Url правильная доменная зона. Скорость работы friGate обеспечена тем, что он открывает заблокированные сайты из собственного заранее составленного списка. Ссылки на главной странице Отношение исходящих ссылок к внутренним ссылкам влияет на распределение веса страниц внутри сайта в целом. Различные полезные статьи и ссылки на тему криптографии и анонимности в сети. Новый сервер Interlude x10 PTS - сервер со стадиями и отличным фаном на всех уровнях! По словам Артёма Путинцева, ситуация с Hydra двойственная. Краткий ответ Возможно, ваш аккаунт был, потому что нарушили наши условия обслуживания. В бесплатной версии приложения доступно всего 500 мегабайт трафика в месяц, а годовой безлимит обойдется в 979 рублей (и это только цена для устройств на iOS). 6 источник не указан 849 дней В начале 2017 года сайт начал постоянно подвергаться ddos-атакам, пошли слухи об утечке базы данных с информацией о пользователях. Просмотр.onion сайтов без браузера Tor(Proxy). Zerobinqmdqd236y.onion - ZeroBin безопасный pastebin с шифрованием, требует javascript, к сожалению pastagdsp33j7aoq. Подробнее: Криптовалютные кошельки: Биткоин, Ефириум, и другие малоизвестные кошельки Банковские карты: Отсутствуют!

Возможность создавать псевдонимы. Onion - cryptex note сервис одноразовых записок, уничтожаются после просмотра. А более широкое распространение он получил в 2002 году, благодаря публикации работы программистов Microsoft, описывающей принципы работы даркнета. Не открываются сайты.onion, пишет это: Попытка соединения не удалась. Прямая ссылка: https searx. Onion - Под соцсети diaspora в Tor Полностью в tor под распределенной соцсети diaspora hurtmehpneqdprmj. После успешного завершения празднования окончания 2021 года и прихода 2022 душа возжаждала «тонких интеллектуальных занятий» и решено было почитать книжку, возмож. Регистрация на бирже Kraken По мере введения этих данных регистрация считается пройденной, а пользователь может приступить к знакомству с личным кабинетом биржевого счета. Вывод средств на Kraken Вывод средств будет недоступен лишь в том случае, если уровень доступа к бирже равен нулю. Цель сети анонимности и конфиденциальности, такой как Tor, не в том, чтобы заниматься обширным сбором данных. ЦРУ Основная причина, по которой ВМС США создали Tor, заключалась в том, чтобы помочь информаторам безопасно передавать информацию через Интернет. Он направлен на продвижение исследований неизлечимых заболеваний, таких как рак, с доступом ко всем беспристрастным научным публикациям. Как уже писали ранее, на официальный сайтах даркнет можно было найти что угодно, но даже на самых крупных даркнет-маркетах, включая Гидру, была запрещена продажа оружия и таких явно аморальных вещей как заказные убийства. Onion - Архив Хидденчана архив сайта hiddenchan. Так, пользователи жалуются на сложность поэтапной верификации и на некомпетентность сотрудников службы поддержки. Относительно стабилен. Этот сервис является хорошим источником статистики, если у вас есть школьный проект, требующий исследования Tor и даркнета. Но может работать и с отключенным. Вот ссылка. Выбор там настолько огромный, что кажется, будто есть вообще всё. Заполнить форму активации аккаунта. Торговая платформа нацелена как на розничных инвесторов, так и на институциональных трейдеров.