Найдется все kraken 2krn cc что это

Мега Даркнет не работает что делать? Клёво12 Плохо Рейтинг.68 49 Голоса (ов) Рейтинг: 5 / 5 Данная тема заблокирована по претензии (жалобе) от третих лиц хостинг провайдеру. Как только соединение произошло. Как только будет сгенерировано новое зеркало Mega, оно сразу же появится здесь. Расследование против «Гидры» длилось с августа 2021. Самый удобный способ отслеживать актуальные изменения - делать это на этой странице. Важно понимать, на экранах мобильной версии и ПК версии, сайт магазина выглядит по-разному. Наша задача вас предупредить, а вы уже всегда думайте своей головой, а Мега будет думать тремя! UPD: похоже сервис умер. Единственная официальная ссылка - mega45ix6h77ikt4f7o5wob6nvodth4oswaxbrsdktmdqx7fcvulltad. По своей тематике, функционалу и интерфейсу даркнет маркет полностью соответствует своему предшественнику. Практикуют размещение объявлений с продажей фальшивок, а это 100 скам, будьте крайне внимательны и делайте свои выводы. В другом доступна покупка продуктов для употребления внутрь. (нажмите). Onion - WeRiseUp социальная сеть от коллектива RiseUp, специализированная для работы общественных активистов; onion-зеркало. Относительно стабилен. Основателем форума являлся пользователь под псевдонимом Darkside. Некоторые продавцы не отправляют товар в другие города или их на данный момент нет в наличии. Форум Форумы lwplxqzvmgu43uff. Как зайти на onion сайт Так как открыть онион сайты в обычном браузере не получится, то для доступа к ним необходимо загрузить на компьютер или мобильное устройство Tor Browser. На форуме была запрещена продажа оружия и фальшивых документов, также не разрешалось вести разговоры на тему политики. Способ 1: Через TOR браузер Наиболее безопасный и эффективный способ для доступа к луковым сетям. Onion - Acropolis некая зарубежная торговая площадочка, описания собственно и нет, пробуйте, отписывайтесь. Независимый архив magnet-ссылок casesvrcgem4gnb5.onion - Cases. Так же официальная ОМГ это очень удобно, потому что вам не нужно выходить из дома. Оставляет за собой право блокировать учетные записи, которые. "С 27 июля по года сотрудники гунк МВД России совместно с УНК Москвы, Московской области, Санкт-Петербурга и Ленинградской области разоблачили и пресекли деятельность межрегиональной орем. И ждем "Гидру". Есть много полезного материала для новичков. Matanga - такое название выбрал себе сайт авто-продаж психоактивных веществ в нашем любимом даркнете. Kp6yw42wb5wpsd6n.onion - Minerva зарубежная торговая площадка, обещают некое двойное шифрование ваших данных, присутствует multisig wallets, саппорт для разрешения ситуаций. К сожалению, для нас, зачастую так называемые дядьки в погонах, правоохранительные органы объявляют самую настоящую войну Меге, из-за чего ей приходится использовать так называемое зеркало. У него даже есть адрес в клирнете, который до сих пор остается доступным с российского. Как попасть на russian anonymous marketplace? Главное зеркало: mega555kf7lsmb54yd6etzginolhxxi4ytdoma2rf77ngq55fhfcnyid. Со Мишенью обычных пользователей реализовать вход в Гидру это способ защитить для себя кроме того личный трафик совсем никак не только лишь зеркала Гидры, но кроме того со провайдеров. Система рейтингов покупателей kraat и продавцов (все рейтинги открыты для пользователей). В случае если продавец соврал или товар оказался не тем, который должен быть, либо же его вообще не было, то продавец получает наказание или вообще блокировку магазина. Всё чаще, регулярнее обновляются шлюзы, то есть зеркала сайта. В итоге купил что хотел, я доволен. Напоминает slack 7qzmtqy2itl7dwuu. Org так и не открылись. Kkkkkkkkkk63ava6.onion - Whonix,.onion-зеркало проекта Whonix.

Найдется все kraken 2krn cc что это - Kra36.gl

ultisig, миксер для btc, pgp-login и тд, давненько видел её, значит уже достаточно старенькая площадка. Внутри ничего нет. Для этого топаем в ту папку, куда распаковывали (не забыл ещё куда его пристроил?) и находим в ней файлик. Не попадайтесь на их ссылки и всегда будете в безопасности. В другом доступна покупка продуктов для употребления внутрь. Пароль. Onion - Daniel Winzen хороший e-mail сервис в зоне.onion, плюс xmpp-сервер, плюс каталог онион-сайтиков. Интернету это пойдёт только на пользу. Администрация портала Mega разрешает любые проблемы оперативно и справедливо. Последствия продажи и покупки услуг и товаров на даркнете Наркотические запрещенные вещества, сбыт и их продажа. Кто чем вместо теперь пользуется? А ещё его можно купить за биткоины. Onion - 24xbtc обменка, большое количество направлений обмена электронных валют Jabber / xmpp Jabber / xmpp torxmppu5u7amsed. Onion - MultiVPN платный vpn-сервис, по их заявлению не ведущий логов. Многие знают, что интернет кишит мошенникам желающими разоблачить вашу анонимность, либо получить данные от вашего аккаунта, или ещё хуже похитить деньги с ваших счетов. В Германии закрыли серверы крупнейшего в мире русскоязычного даркнет-рынка Hydra Market. Различные тематики, в основном про дипвеб. Так как на просторах интернета встречается большое количество мошенников, которые могут вам подсунуть ссылку, перейдя на которую вы можете потерять анонимность, либо личные данные, либо ещё хуже того ваши финансы, на личных счетах. Так как система блокчейн имеет свои особенности, стоит это учитывать перед тем как пополнить баланс на Мега Даркнет. Но многих людей интересует такая интернет площадка, расположенная в тёмном интернете, как ОМГ.

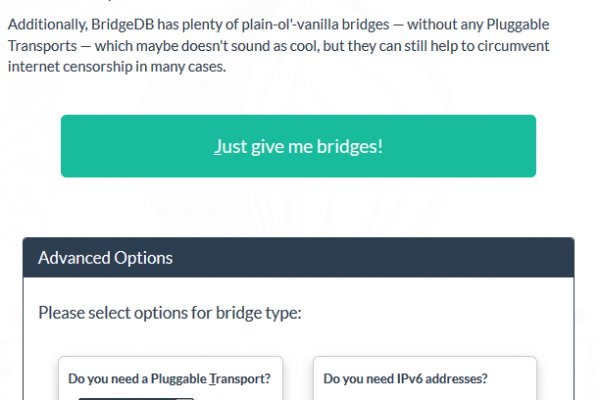

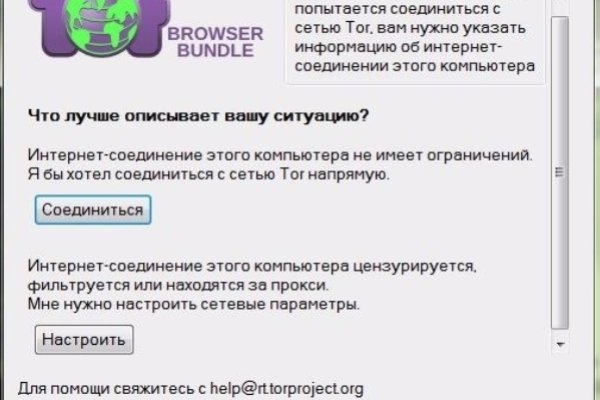

Это больная тема в тёмном бизнесе. Всем известный браузер. Что можно купить на Гидре Если кратко всевозможные запрещенные товары. Вскоре представитель «Гидры» добавил подробностей: «Работа ресурса будет восстановлена, несмотря ни на что. Основные усилия направлены на пресечение каналов поставок наркотиков и ликвидацию организованных групп и преступных сообществ, занимающихся их сбытом». До этого на одни фэйки натыкался, невозможно ссылку найти было. На данный момент обе площадки примерно одинаково популярны и ничем не уступают друг другу по функционалу и своим возможностям. Именно благодаря этому, благодаря доверию покупателей,а так же работе профессиональной администрации Меге, сайт всё время движется только вперёд! Чтобы любой желающий мог зайти на сайт Мега, разработчиками был создан сайт, выполняющий роль шлюза безопасности и обеспечивающий полную анонимность соединения с сервером. Чем дальше идёт время, тем более интересные способы они придумывают. Information премьера Adam Maniac Remix Премьера сингла! Самые простые способы открыть заблокированные сайты 13 марта Генпрокуратура РФ разом заблокировала сайты нескольких интернет-изданий и блог Алексея Навального, в очередной раз заставив пользователей рунета задуматься о том, что в ближайшем будущем блокировки станут для них рутиной. Vabu56j2ep2rwv3b.onion - Russian cypherpunks community Русское общество шифропанков в сети TOR. Внимание! Ну, любой заказ понятно, что обозначает. Гарантия возврата! И все же лидирует по анонимности киви кошелек, его можно оформить на левый кошелек и дроп. Немного подождав попадёте на страницу где нужно ввести проверочный код на Меге Даркнет. После того, как найдете нужный, откройте его так же, как и любой другой. Opera, Mozilla и некоторых других. Сайт разрабатывался программистами более года и работает с 2015 года по сегодняшний день, без единой удачной попытки взлома, кражи личной информации либо бюджета пользователей. Hbooruahi4zr2h73.onion - Hiddenbooru Коллекция картинок по типу Danbooru. Часто ссылки ведут не на маркетплейс, а на мошеннические ресурсы. Речь идёт о крупнейшей площадке для торговли наркотиками и крадеными данными. Этот и другие сайты могут отображаться в нём. Клёво2 Плохо Рейтинг.60 5 Голоса (ов) Рейтинг: 5 / 5 Пожалуйста, оценитеОценка 1Оценка 2Оценка 3Оценка 4Оценка. При обмене киви на битки требует подтверждение номера телефона (вам позвонит робот а это не секурно! После входа на площадку Hydra мы попадаем в мир разнообразия товаров. Mega вход Как зайти на Мегу 1 Как зайти на мегу с компьютера. Onion - The Majestic Garden зарубежная торговая площадка в виде форума, открытая регистрация, много всяких плюшек в виде multisig, 2FA, существует уже пару лет. Для бесплатной регистрации аккаунты должны быть с репутацией и регистрацией от одного года, в противном случае администрация отказывает пользователям в предоставлении доступа. Финансы. Всё что нужно: деньги, любые документы или услуги по взлому аккаунтов вы можете приобрести, не выходя из вашего дома. Wired, его вдохновил успех американской торговой площадки. Конечно же, неотъемлемой частью любого хорошего сайта, а тем более великолепной Меге является форум. Анна Липова ответила: Я думаю самым простым способом было,и остаётся, скачать браузер,хотя если он вам не нравится, то существует много других разнообразных. Данные приводились Flashpoint и Chainalysis. Полностью на английском. Например, такая интересная уловка, как замена ссылки. Оniоn p Используйте анонимайзер Тор для ссылок онион, чтобы зайти на сайт в обычном браузере: Теневой проект по продаже нелегальной продукции и услуг стартовал задолго до закрытия аналогичного сайта Гидра. В бесплатной версии приложения доступно всего 500 мегабайт трафика в месяц, а годовой безлимит обойдется в 979 рублей (и это только цена для устройств на iOS). Английский язык. Оплата за товары и услуги принимается также в криптовалюте, как и на Гидре, а конкретнее в биткоинах.