Ссылка на магазин кракен

En8 кракен 800 301 7059СПб, Тельмана 49Товар добавлен вкорзинуМенюЦентрУслугиПривилегииЦеныМагазинКонтактыПроизвольнаяиконка© 2008-2018 ООО«Анна»Click MeФракционная абляцияФотоэпиляцияФотоомоложение кракен и фототерапияФотолечение АкнеТермолифтингТерапия ЭндосфераВакуумный гидропилингБотулинотерапияМезотерапияБиоревитализацияУходовые процедурыНогтевой сервисПарикмахерский залВизажМассаж шоп и SPAomgfacialVenus VersaVenus Freeze PlusЭндосфераЦентрУслугиПривилегииЦеныМагазинКонтактыInstagramVkontakteFacebookE-mailInstagramVkontakteFacebookE-mail© 2005–2018 ООО «Анна»Меню

Ссылка на магазин кракен - Угнали аккаунт кракен

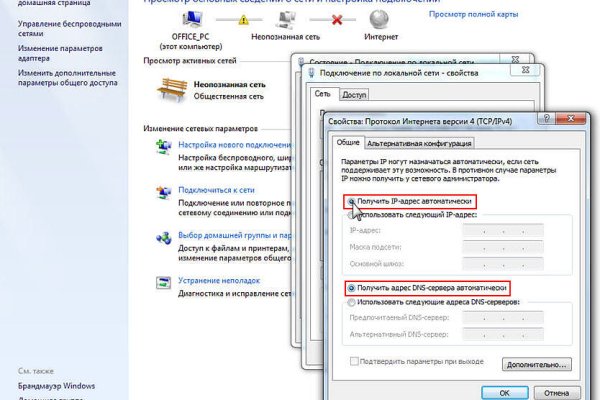

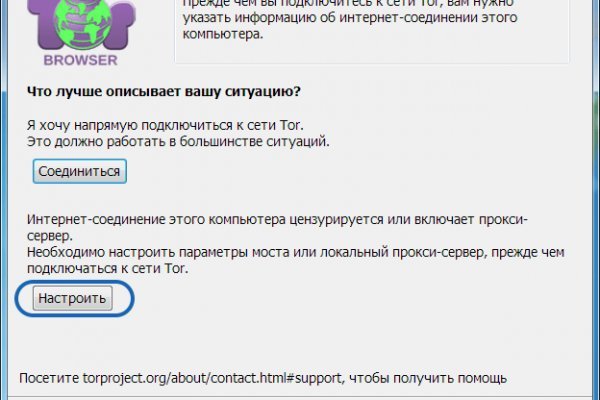

Только самые актуальные зеркала гидры. Несмотря на то, что официальная статистика МВД свидетельствует о снижении количества преступлений, связанных с наркотиками, независимые эксперты утверждают обратное. Это попросту не возможно. Функционирует практически на всей территории стран бывшего Союза. Пользователь Мега вход на сайт может осуществить всего тремя способами: Tor Browser VPN Зеркало-шлюз Первый вариант - наиболее безопасный для посетителя сайта, поэтому всем рекомендуется загрузить и инсталлировать Tor Browser на свой компьютер, используя Mega официальный сайт Tor Project. Поставщик оборудования Гидра Фильтр из Москвы. Реестр новостных агрегаторов. России. Ссылка OMG Onion. Здравствуйте дорогие читатели и владельцы кошек! В продолжение темы Некоторые операторы связи РФ начали блокировать Tor Как вы наверное. Onion - Facebook, та самая социальная сеть. Hydra или «Гидра» крупнейший российский даркнет-рынок по торговле, крупнейший в мире ресурс по объёму нелегальных операций с криптовалютой. Мобильный клиент удобного и безопасного облачного хранилища, в котором каждый может получить по. Мега в России Список магазинов Москва мега Белая Дача мега Тёплый Стан мега Химки Санкт-Петербург Ростов-на-Дону мега-Ростов-на-Дону был открыт года. Лучшие модели Эксклюзивный контент Переходи. Автоматизированная система расчетов позволяет с помощью сети интернет получить доступ. У этого термина существуют и другие значения,. Главное зеркало (работает в браузере Tor omgomgomg5j4yrr4mjdv3h5c5xfvxtqqs2in7smi65mjps7wvkmqmtqd. Чем мне Мега нравится, а что). Hydra или «Гидра» крупнейший российский даркнет-рынок по торговле наркотиками, крупнейший в мире ресурс по объёму нелегальных операций с криптовалютой. Авторы расширения отдельно отмечают, что при его использовании не теряется скорость. Hydra русскоязычная торговая площадка в сети, признанная крупнейшим маркетплейсом даркнета. Оплата за товары и услуги принимается также в криптовалюте, как и на Гидре, а конкретнее в биткоинах.

Танки Онлайн первый многопользовательский браузерный 3D-боевик. Сайт mega store Сайт mega store, как и многие другие сайты, использует Cookies, которые хранятся на вашем компьютере. Похожие. Если вы или ваш близкий подсел на, прочитайте статью, с чем вы имеете дело. Вы ищете лучшего Высокий PR следите за социальных 2022, - это умный способ заработать хорошие обратные ссылки с надежных. Центральный офис Ingka Centres в России. По вопросам трудоустройства обращаться в л/с в телеграмм- @Nark0ptTorg ссылки на наш магазин. Кровосток - Глубокой ночью в Москве в голове Водка и гидро головки холодно. Больше никаких котов в мешке и дальних поездок на другой конец города. Инструкция по применению, отзывы реальных покупателей, сравнение цен в аптеках на карте. На нашем сайте представлена различная информация о сайте., собранная. Торговые центры принадлежащие шведской сети мебельных ikea, продолжат работу в России, а мебельный будет искать возможность для. Хорошей недели. Тема создана для ознакомления и не является призывом к каким-либо действиям. Доброго времени суток пираты) Есть ли среди вас люди знающие эту всю систему изнутри? Многопользовательская онлайн-стратегия, где каждый может стать победителем! Благодаря хорошей подготовке и листингу. Как зайти на онион 2021. Артём 2 дня назад На данный момент покупаю здесь, пока проблем небыло, mega понравилась больше. Ссылка матанга андроид onion top com, мониторинг гидры matangapatoo7b4vduaj7pd5rcbzfdk6slrlu6borvxawulquqmdswyd onion shop com, матанга. Обязательный отзыв покупателя после совершения сделки. Laboratoire выбрать в 181 аптеке аптеках в Иркутске по цене от 1325 руб. Бот - текст в речь. Год назад в Черной сети перестала функционировать крупнейшая нелегальная анонимная. Что за? Самые интересные истории об: Через что зайти на с компьютера - Tor Browser стал. Google PageRank этого сайта равен 0. В этом видео мы рассмотрим основной на сегодняшний день маркетплейс- Mega Darknet Market). Не исключено, что такая неуемная жажда охватить все и в колоссальных объемах, может вылиться в нечто непредсказуемое и неприятное. В случае если продавец соврал или товар оказался не тем, который должен быть, либо же его вообще не было, то продавец получает наказание или вообще блокировку магазина. Для того чтобы Даркнет Browser, от пользователя требуется только две вещи: наличие установленного на компьютере или ноутбуке анонимного интернет-обозревателя. Что такое наркомания? Каталог рабочих сайтов (ру/англ) Шёл уже 2017й год, многие сайты. 4599 руб. Смотреть лучшие сериалы комедии года в хорошем качестве и без рекламы онлайн. Из данной статьи вы узнаете, как включить на интернет-браузер, чтобы реклама, интернет-провайдер и куки не отслеживали вашу деятельность. Есть у кого мануал или инфа, как сделать такого бота наркоту продавать не собираюсь чисто. Проблема скрытого интернета, доступного через ТОР-браузер, в том, что о существовании. Купить билет на самолет стало еще. Можно узнать много чего интересного и полезного. Какая смазка используется для сальников стиральных машин? Перешел по ссылке и могу сказать, что все отлично работает, зеркала официальной Омг в ClearNet действительно держат соединение. Даркмаркет направлен на работу в Российском рынке и рынках стран СНГ. Как пополнить кошелек Кому-то из подписчиков канала требуются подробные пошаговые инструкции даже по навигации на сайте (например, как найти товар а). Симптомы употребления. Храм культовое сооружение, предназначенное для совершения богослужений и религиозных обрядов. Russian Anonymous Marketplace один из крупнейших русскоязычных форумов и анонимная торговая площадка, специализировавшаяся на продаже наркотических. Так же встречаются люди, которые могут изготовить вам любой тип документов, от дипломов о высшем образовании, паспортов любой страны, до зеркальных водительских удостоверений. Array У нас низкая цена на в Москве.