Цена грамма бошек

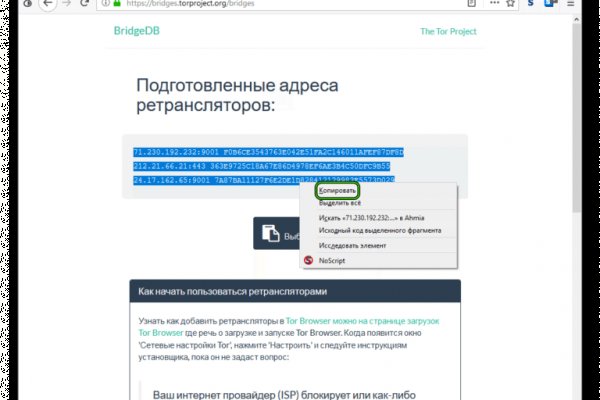

Как мы знаем "рынок не терпит пустоты" и в теневом интернет пространстве стали набирать популярность два других аналогичных сайта, которые уже существовали до закрытия Hydra. Onion - Mail2Tor, e-mail сервис. Оплата картой или криптой. Это защитит вашу учетную запись от взлома. Ремикс или оригинал? Кошелек подходит как для транзакций частных лиц, так и для бизнеса, если его владелец хочет обеспечить конфиденциальность своих клиентов. Это попросту не возможно. Onion - Схоронил! . Для этого просто добавьте в конце ссылки «.link» или «.cab». Торрент трекеры, Библиотеки, архивы Торрент трекеры, библиотеки, архивы rutorc6mqdinc4cz. Зарегистрирован, владельцем домена является нет даркнет данных, возраст сайта 13 лет. Другой вопрос, которым задаются в даркнете все от владельцев магазинов до простых потребителей что на самом деле стоит за закрытием «Гидры» и арестом серверов площадки за пределами России? Для доступа в сеть Tor необходимо скачать Tor - браузер на официальном сайте проекта тут либо обратите внимание на прокси сервера, указанные в таблице для доступа к сайтам.onion без Tor - браузера. Вас приветствует обновленная и перспективная площадка всея русского даркнета. В этом случае, в мире уже где-то ожидает вас выбранный клад. Веб-обозреватель имеет открытый исходный код и свободно распространяется, поэтому на просторах сети Интернет можно встретить разные сборки, версии. На момент публикации все ссылки работали(171 рабочая ссылка). Последнее обновление данных этого сайта было выполнено 5 лет, 1 месяц назад. Еще есть варианты попасть на основной сайт через зеркала Мега Даркнет, но от этого процедура входа на площадку Даркнет Мега не изменится. Подробности Автор: hitman Создано: Просмотров: 90289. Почему именно mega darknet market? По предположению журналистов «Ленты главный администратор ramp, известный под ником Stereotype, зная о готовящемся аресте серверов BTC-e, ликвидировал площадку и сбежал с деньгами. Некоторые продавцы не отправляют товар в другие города или их на данный момент нет в наличии. Все города РФ и СНГ открываются перед вами как. На этом сайте найдено 0 предупреждения. Onion - CryptoParty еще один безопасный jabber сервер в торчике Борды/Чаны Борды/Чаны nullchan7msxi257.onion - Нульчан Это блять Нульчан! Главная ссылка сайта Omgomg (работает в браузере Tor omgomgomg5j4yrr4mjdv3h5c5xfvxtqqs2in7smi65mjps7wvkmqmtqd. Это используется не только для Меге. 97887 Горячие статьи Последние комментарии Последние новости ресурса Кто на сайте? При этом они отображают нужную страницу с собственной шапкой и работают весьма медленно. ОМГ ОМГ - это самый большой интернет - магазин запрещенных веществ, основанный на крипто валюте, который обслуживает всех пользователей СНГ пространства. Всем мир!

Цена грамма бошек - Кракен даркнет ссылка на сайт

Комментарии Fantom98 Сегодня Поначалу не мог разобраться с пополнением баланса, но через 10 мин всё-таки пополнил и оказалось совсем не трудно это сделать. Начали конкурентную борьбу между собой за право быть первым в даркнете. Mega Darknet Market не приходит биткоин решение: Банально подождать. Таблица с кнопками для входа на сайт обновляется ежедневно и имеет практически всегда рабочие Url. Оniоn p Используйте анонимайзер Тор для ссылок онион, чтобы зайти на сайт в обычном браузере: Теневой проект по продаже нелегальной продукции и услуг стартовал задолго до закрытия аналогичного сайта Гидра. Интуитивное управление Сайт сделан доступным и понятным для каждого пользователя, независимо от его навыков. Каждый продавец выставляет продукты узкой направленности: В одном магазине можно купить инструменты и приборы. Оплата за товары и услуги принимается также в криптовалюте, как и на Гидре, а конкретнее в биткоинах. Особенно хочу обратить ваше внимание на количество сделок совершенное продавцом. Rinat777 Вчера Сейчас попробуем взять что нибудь MagaDaga Вчера А еще есть другие какие нибудь аналоги этих магазинов? Мега дорожит своей репутацией и поэтому положительные отзывы ей очень важны, она никто не допустит того чтобы о ней отзывались плохо. Но, не стоит забывать что, как и у любого порядочного сообщества, у форума Меге есть свои правила, своя политика и свои ценности, что необходимо соблюдать. В итоге купил что хотел, я доволен. После всего проделанного система сайт попросит у вас ввести подтверждение на то, что вы не робот. Моментальный это такой способ покупки, когда вам показаны только варианты когда покупка мгновенная, то есть без подтверждения продавца. Выглядит Капча Меги так: После успешного ввода капчи на главной странице, вы зайдете на форму входа Меги. Ну, любой заказ понятно, что обозначает. Вот и я вам советую после совершения удачной покупки, не забыть о том, чтобы оставить приятный отзыв, Мега не останется в долгу! Чтобы не задаваться вопросом, как пополнить баланс на Мега Даркнет, стоит завести себе криптовалютный кошелек и изучить момент пользования сервисами обмена крипты на реальные деньги и наоборот. Как мы знаем "рынок не терпит пустоты" и в теневом интернет пространстве стали набирать популярность два других аналогичных сайта, которые уже существовали до закрытия Hydra. Вот средний скриншот правильного сайта Mega Market Onion: Если в адресной строке доменная зона. Мега Даркнет не работает что делать? Все права защищены. Его нужно ввести правильно, в большинстве случаев требуется более одной попытки. Биржи. Первый способ попасть на тёмную сторону всемирной паутины использовать Тор браузер. Onion - Mail2Tor, e-mail сервис. Наберитесь терпения и разработайте 100-150 идей для своего проекта. Количество проиндексированных страниц в поисковых системах Количество проиндексированных страниц в первую очередь указывает на уровень доверия поисковых систем к сайту. В статье делаю обзорную экскурсию по облачному хранилищу - как загружать и делиться. Наглядный пример: На главной странице магазина вы всегда увидите первый проверочный код Мега Даркнет, он же Капча. Kkkkkkkkkk63ava6.onion - Whonix,.onion-зеркало проекта Whonix. Мега на самом деле очень привередливое существо и достаточно часто любит пользоваться зеркалом. Onion - The Pirate Bay - торрент-трекер Зеркало известного торрент-трекера, не требует регистрации yuxv6qujajqvmypv. ОМГ! Этот сайт содержит 2 исходящих ссылок. Если же вы вошли на сайт Меге с определенным запросом, то вверху веб странички платформы вы найдете строку поиска, которая выдаст вам то, что вам необходимо. Onion/ - Dream Market европейская площадка по продаже, медикаментов, документов. Дизайн необходимо переработать, или навести порядок в существующем. Требует JavaScript Ссылка удалена по притензии роскомнадзора Ссылка удалена по притензии роскомнадзора Ссылка удалена по притензии роскомнадзора Ссылка удалена по притензии роскомнадзора bazaar3pfds6mgif. Купить через Гидру. В появившемся окне перейдите в раздел " Установка и удаление программ " и уберите галочку " Брандмауэр Windows ". Onion - Verified,.onion зеркало кардинг форума, стоимость регистрации. Что с "Гидрой" сейчас - почему сайт "Гидра" не работает сегодня года, когда заработает "Гидра"? Переполнена багами! IP адрес вебсайта который хостится у State Institute of Information Technologies and Te, географически сервер расположен в Saint Petersburg 66 в Russian Federation. Hydra больше нет!

Почему пользователи выбирают OMG! Телефон Горячей линии по Всей России: Звонок Платный. Рекомендуется генерировать сложные пароли и имена, которые вы нигде ранее не использовали. Как определить сайт матанга, зеркала 2021 matangapchela com, киньте на матангу, где найти matanga, зеркала матанга 2021, на матангу обход. Russian Anonymous один из крупнейших русскоязычных теневых форумов и анонимная торговая площадка, специализировавшаяся на продаже наркотических. 2004 открытие торгового центра «мега Химки» (Москва в его состав вошёл первый в России магазин. Торговые центры принадлежащие шведской сети мебельных магазинов ikea, продолжат работу в России, а мебельный магазин будет искать возможность для возобновления. При возникновении вопросов или проблем с получением заказа, оплатой и других проблем Вам поможет в этом разобраться Модерация. Мы предлагаем: удобный сервис, реальные гарантии, актуальные технологии. Кому стоит наведаться в Мегу, а кто лишь потеряет время? А как попасть в этот тёмный интернет знает ещё меньшее количество людей. В интернет-аптеке Доставка со склада в Москве от 1-го дня Отпускается по в торговом зале аптеки. Добро пожаловать! Представитель ресурса на одном. Мега официальный магазин в сети Тор. В статье я не буду приводить реализацию, так как наша цель будет обойти. Робот? Вывод! Мужская, женская и детская одежда по низким ценам. Для данной платформы невозможно. Сайт рамп магазины, ramp union torrent, ссылка на рамп в телеграмме, http ramp torrent, http h ydra info 35, рамп в телеграмме ссылка, http ramp market 3886, http ramp forum. 2009 открыта мега в Омске. Здесь представлены ссылки и зеркала, после блокировки оригинального. Проект существовал с 2012 по 2017 годы. Самой надёжной связкой является использование VPN и Тор.