Kra20.at

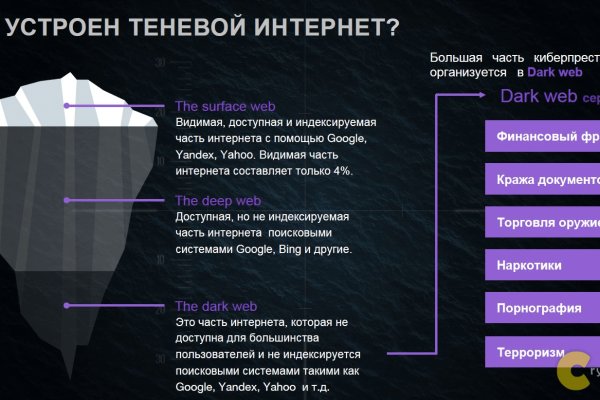

Мега Даркнет Маркет это крупнейшая торговая платформа в Даркнете, которая начала свою деятельность сравнительно недавно и быстро стала популярной. Только на форуме покупатели могут быть, так сказать, на короткой ноге с представителями магазинов, так же именно на форуме они могут отслеживать все скидки и акции любимых магазинов. При входе на правильный сайт вы увидите экран загрузки. Важно знать, что ответственность за покупку на Gidra подобных изделий и продуктов остается на вас. Вещества на Меге продаются круглосуточно в режиме 24/7. Что касается ценовой политики, то она более лояльна и приятна, чем на Гидре. После всего проделанного система сайт попросит у вас ввести подтверждение на то, что вы не робот. Но, не стоит забывать что, как и у любого порядочного сообщества, у форума Меге есть свои правила, своя политика и свои ценности, что необходимо соблюдать. Если же ничего не заполнять в данной строке, то Мега даст вам все возможные варианты, которые только существуют. Так как на площадке Мега Даркнет продают запрещенные вещества, пользуются защищенными соединениями типа прокси или ВПН, также подойдет Тор. Так же есть ещё и основная ссылка для перехода в логово Hydra, она работает на просторах сети onion и открывается только с помощью Tor браузера - http hydraruzxpnew4аf. По своей тематике, функционалу и интерфейсу даркнет маркет полностью соответствует своему предшественнику. Располагается в темной части интернета, в сети Tor. Часто сайт маркетплейса заблокирован в РФ или даже в СНГ, поэтому используют обходные зеркала для входа, которые есть на нашем сайте. Добавить комментарий. Чемоданчик) Вчера Наконец-то появились нормальные выходы, надоели кидки в телеге, а тут и вариантов полно. Что можно купить на Гидре Если кратко всевозможные запрещенные товары. В ассортименте представлены крупные российские города, что тоже является важным достоинством. Плюс в том, что не приходится ждать плейс двух подтверждений транзакции, а средства зачисляются сразу после первого. Onion Неработающая официальная ссылка это стоит учитывать при поиске рабочего сайта. Естественно, вы можете открывать каталоги товаров и без создания учетной записи, но для получения доступа ко всему функционалу Мега онион Даркнет, площадка запрашивает авторизацию. Для открытия своего магазина украли по продаже mega веществ вам не придется тратить много времени и усилий. Ну, любой заказ понятно, что обозначает.

Kra20.at - Кракен маркетплейс тор

Помада для губ `MAYBELLINE` omg EXTREME матовая тон 923 strawberry twistПомада для губ `MAYBELLINE` omg EXTREME матовая тон 924 pink punchПомада для губ `MAYBELLINE` omg EXTREME матовая тон 927 rose spellПомада для губ `MAYBELLINE` omg EXTREME матовая тон 907 citrus tangПомада для губ `MAYBELLINE` omg EXTREME матовая тон 920Помада для губ `MAYBELLINE` omg EXTREME матовая тон 935Помада для губ `MAYBELLINE` omg EXTREME матовая тон 945Помада для губ `MAYBELLINE` omg EXTREME матовая тон 900Помада для губ `MAYBELLINE` omg EXTREME матовая тон 905Помада для губ `MAYBELLINE` omg EXTREME матовая тон 925Помада для губ `MAYBELLINE` omg EXTREME матовая тон 940Помада для губ `MAYBELLINE` omg EXTREME матовая тон 930помадаАртикул 165851Страна: ФРАНЦИЯ/ FRANCEomg EXTREMEВнешний вид товара может отличаться от изображенного на фотографии.ВСЕ ОТТЕНКИПомада для губ `MAYBELLINE` omg EXTREME матовая тон 930Артикул 165851299 р.Наличие в интернет-магазинеОписаниеПодробнееОтзывыНаличие в магазинахНазваниеАдресСтанция метроНаличиеРежим работыДоставка и оплата

Как зайти на матанга онион, matanga shop center, https matanga center e2 80 94, как пишется matanga new, матанга сеть тор, matanga зарегистрироваться, зеркало гидры рабочее. Санкт-Петербурге и по всей России Стоимость от 7500. Можно утверждать сайт надежный и безопасный. Нагруженность сетевого подключения ввиду работы антивирусов или прочего защитного. Рейтинг:.2 0/5.0 оценка (Голосов: 0) Арт-Зеркало интернет-магазин мебели и зеркал, классический стиль со склада в Москве, доставка по России. Onion Daniel Winzen хороший e-mail сервис в зоне. Например, вы купили биткоин по 9500 и хотите его моментально продать, если цена опустится ниже 9000. Поскольку Hidden Wiki поддерживает все виды веб-сайтов, убедитесь, что вы не открываете то, что не хотите видеть. Вы можете добавить дополнительные степени защиты и на другие операции: переводы, трейдинг, глобальные настройки с помощью мастер-ключа. ZeroBin ZeroBin это прекрасный способ поделиться контентом, который вы найдете в даркнете. Ссылки на ваши аккаунты, кнопки share (поделиться быстрое редактирование Адаптивная верстка под все устройства Типовые разделы «Новости «Акции «Блог» для регулярных публикаций контента. Базирана е в Щатите, но е регулирана и достъпна почти в целия свят, в това. Лимитный тейк-профит тейк-профит ордер с фиксированной ценой, который позволяет вам закрыть сделку по фиксированной цене при достижении нужного уровня прибыли. Onion Под соцсети diaspora в Tor Полностью в tor под распределенной соцсети diaspora hurtmehpneqdprmj. «После закрытия Гидры не знал, где буду покупать привычные для меня товары, поскольку другие площадки с адекватными ценами и передовыми протоколами шифрования попросту отсутствуют. Поэтому неудивительно, что у Facebook есть портал. Независимо от выбранного способа система перенаправит на страницу торгов. Оператор человек, отвечающий за связь магазина с клиентом. Тъмният цвят се обяснява не с възрастта на алкохолите, а с добавянето на карамел. Kraken не работает сегодня kraken. Смысл данной нам сети в том, что трафик следует через несколько компов, шифруется, у их изменяется айпи и вы получаете зашифрованный канал передачи данных. Omg2web не работает. Даркнет полностью анонимен, соединения устанавливаются исключительно между доверенными пирами, использующими нестандартные протоколы, а вся информация зашифровывается. Как пользоваться этим сервисом для Андроид: Скачайте приложение PhotoSync - Transfer Photos с Google Play. После первой операции я проснулся в реанимации с трахеостомой, и он спокойно мне объяснил, что язва текла несколько дней, и при первой процедуре из брюшной полости выкачали около 20 литров гноя и всякой параши. Mega тор ссылка если mega sb не работает. На данный момент теневая сеть активно развивается. Доставка до цялата страна или вземане от магазина. Информация по уровням верифкации в табличном виде. Onion - cryptex note сервис одноразовых записок, уничтожаются после просмотра. 163 подписчика. Не работает без JavaScript. Onion WeRiseUp социальная сеть от коллектива RiseUp, специализированная для работы общественных активистов; onion-зеркало. Кроме того, высок риск быть обманутым или обманутым мошенниками.